A Reflection on the Federal Reserve “How We Pay” Study

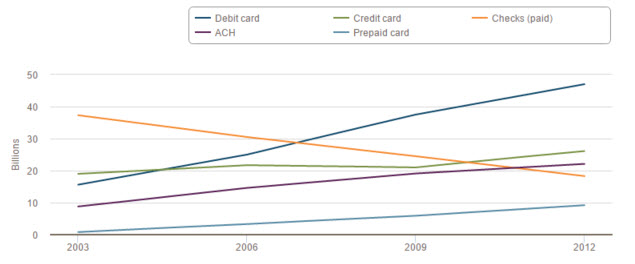

With the implementation of EMV (chip cards) and integrated POS-systems, we wanted to provide an update on one the more important studies annually released by the Federal Reserve Bank called “How We Pay”. It highlights the method of payment transactions nationally and is organized by share of payments and volume of payments. The study focuses on non-cash based transaction including credit cards, debit cards, prepaid cards, automated clearinghouse (ACH), and checks. The trend in the U.S. has been speeding toward debit and credit card transactions over the past 20 years, and we like to keep an eye on where it’s headed every year. Since 1995 when debit and credit cards made up a combined 17% of transaction volume, the amount has increase more than threefold to nearly 64%.

With the recent introduction of card-centric point-of-sale systems that organize businesses from shipping dock to sales counter, the trend for card-based transactions continues to grow. Looking strictly at the data trend, the 20-year increase in card usage will continue into the future.

Many factors influence trends in noncash payments, including technological and financial innovations, changes in consumer and business financial behavior, the business cycle, regulatory developments, and population growth. Past payments studies revealed a number of notable trends, such as the rise in the use of debit and prepaid cards and the decline in the use of checks.

Cards hold a strengthening portion of payments

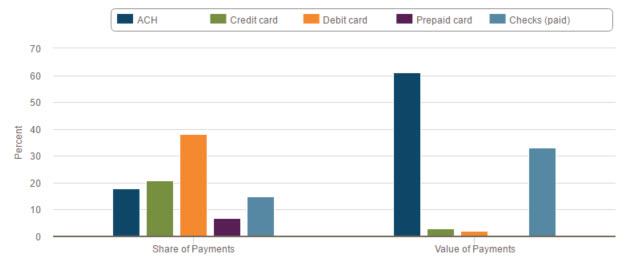

The study found that cards increased their share of total noncash payments, from 43 percent in 2003 to 67 percent today. Checks represented nearly half (46 percent) of all noncash payments in 2003, but only 15 percent today (see chart below).

The payments study broke down card payments into two broad categories: general-purpose and private-label cards. Credit card payments (including both general purpose and private label)—which declined slightly from 2006 to 2009—returned to growth from 2009 to 2012. The number of credit card transactions grew at an annual rate of 7.6 percent, rising from 21 billion in 2009 to 26.2 billion in 2012.

Highlights from the study

Fostering future payment trends

As we look to the future, we are preparing for an increase in overall card payments. Our business is built on helping small businesses make the transition to an efficient payment processing system. Believe it or not, there are still some companies that don’t accept card payments. It’s our job to be there when they are ready for the change, but we also do a lot of community engagement to promote the importance of accepting cards based on the statistics above. An ever-increasing segment of the population is using cards for nearly every payment. We want to educate and make it easy for business to accommodate those transaction while gaining deeper insights into their business.

MOVING FORWARD

In an ever changing business environment, you need to keep up with technology and innovations. This could be what separates you from your competition. This could be why your employees chose to work with you. Your younger employees have relied on technology and are comfortable knowing that this technology is what is responsible for their pay checks, deposit and tax filing. Even with these five tips, a business owner needs to be involved and provide routine checks to make sure the machine is well oiled.

Need help with payroll or your day to day operations? We have spent the last 20 years building relationships with local companies and are proud of the networking circle we are involved in. We would be happy to refer you to one of our strategic partners.

Our motto is “Moving Forward” and it is our desire to help your business positively grow in many ways. Get started today by calling us at 608-819-8666 or visit us online anytime at www.MotusCC.com.

Our POS systems are designed to streamline in-store transactions. With features like inventory management, sales reporting, and customer tracking, our POS solutions help you run your business more efficiently. Our terminals are compatible with various payment methods, including chip cards, contactless payments, and mobile wallets.

Our POS systems are designed to streamline in-store transactions. With features like inventory management, sales reporting, and customer tracking, our POS solutions help you run your business more efficiently. Our terminals are compatible with various payment methods, including chip cards, contactless payments, and mobile wallets.